Tech trends in insurance you should know

Technological change is revolutionising the insurance sector. From artificial intelligence (AI) to robotics and beyond, work on-shore, in the port and in the office is being transformed: automation is the driving force behind this, but robots are not just for heavy-lifting. In fact, robotic process automation has already had an impact in office environments by lowering the burden of routine administrative work as we move away from paper-based processes, this allows insurance professionals to work on high value tasks.

The fast-moving technological change can seem like a whirlwind but the end goal of smarter working, new opportunities and improved profitability is one that every insurance professional can appreciate.

1. The intelligent system revolution

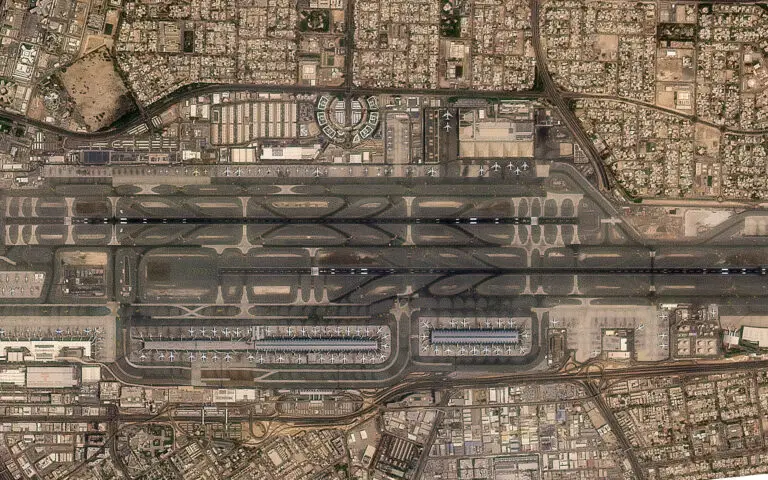

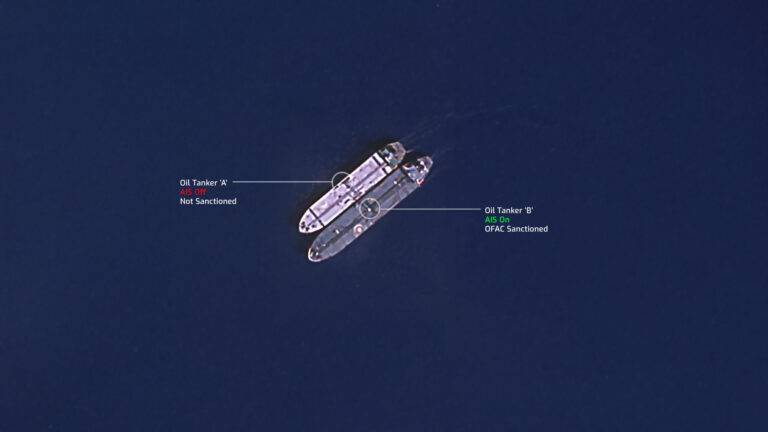

The seemingly endless ‘AI winter’ has thawed. Cloud computing, with effectively unlimited storage and processing power, has driven a revolution in artificial intelligence outside the computer science lab making data a central concern of business across the board. Intelligent systems can now make decisions and, more importantly, analyse raw data to drive decision human making by providing a wider, global picture of risk. Recording and analysing patterns in behaviour, including but not limited to vessel movement, has an obvious benefit for the marine insurance sector by increasing visibility across insured activities and time. The knock-on effect on pricing and claims promises to drive greater profitability across the board.

2. Robots at work

Robotic process automation has been a talking point in industry in recent years, but the deploying of automated IT processes should not occlude the fact that physical robots are having an impact on work in the material world. The future of shipping will inevitably see changes in crewing numbers, with more and more work performed by quasi-intelligent robots able to use sensor data to respond to their environment and loads.

3. Cognitive technology

Technologies such as natural language processing and object recognition move IT away from processing numbers to ‘thinking’, if not quite reasoning, like humans. The implementation of cognitive technology in insurance has an obvious benefit in reducing paper-based administration tasks but also has the potential to support compliance by automating in-port and on-vessel activities and reducing the need for human oversight.

4. Sharing Economy

Open source software has revolutionised IT in recent decades, but software is not the only open domain. Indeed, data is a vital area where open source information – from vessel registries to company registration information – can be pulled into the mix and used to augment and validate decision making. In future, sharing of data between partners will also make a contribution as key players in the insurance sector think in terms of the alignment of their interests rather than commercial sensitivity.

5. Blockchain

Best known for its use in cryptocurrency, blockchain is a much wider technology. While it is still to prove its efficacy – concerns remain over energy use and duplication – blockchain nonetheless needs to be studied as the distributed ledger technology promises the ability for multiple parties to share data that cannot be altered ex post facto. The end result of this is that all parties are working from the same, trusted information and the potential for fraud is significantly diminished.

To keep one step ahead and make technology work for you, read more in our CUO’s Guide to Industry 5.0, Ebook series. Click the banner below for part 2 Leading Compliance.