Exposure Management

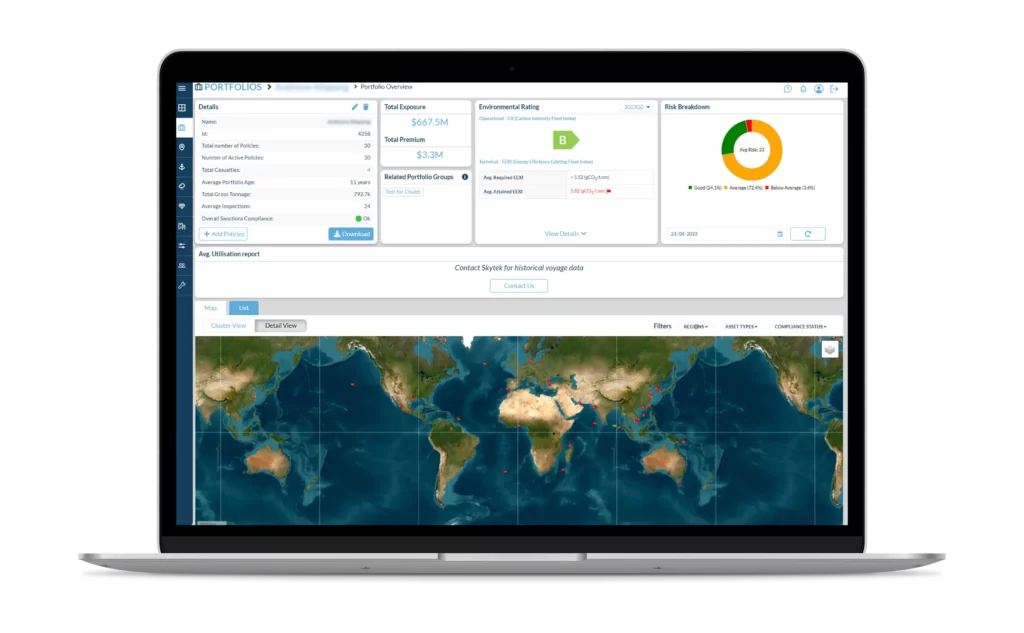

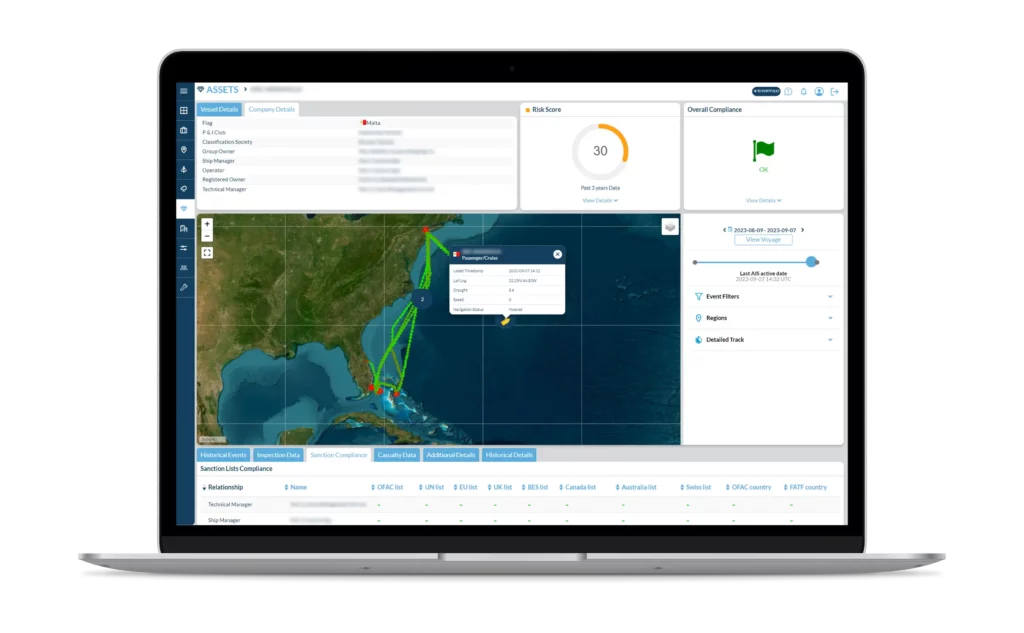

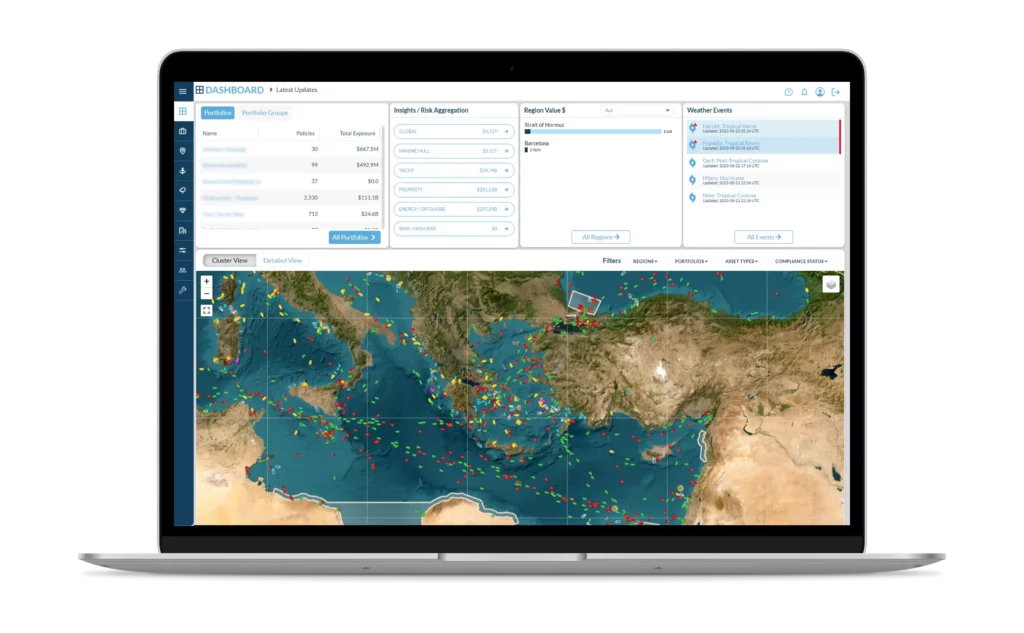

We track assets movements and use this information to help insurers easily detect and prevent risk aggregation. Historical analysis allows companies to understand better asset movements and the spread of the risk on a global scale.

Risk Scoring

Our proprietary scoring system helps marine insurers to improve underwriting decision making, easily compare organisations and target new clients.

Claims Management

Assess the validity of potentially “in dispute” claims, such as vessels ‘lost at sea’. Real-time monitoring will confirm location, track movements, weather conditions, and other information to understand underlying claim circumstances better.

How it Works

- Assets and portfolios are uploaded to our platform where they are monitored 24/7

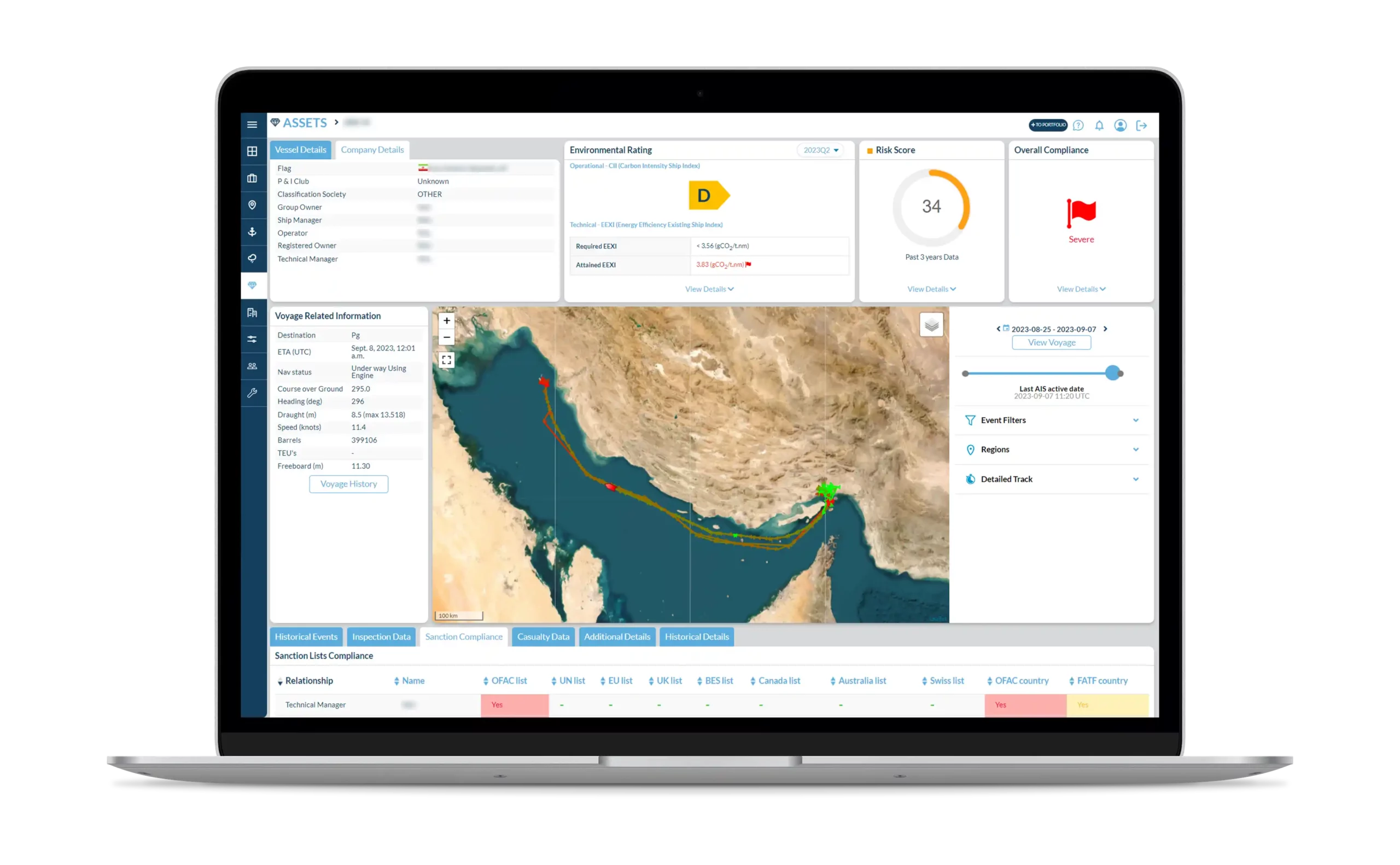

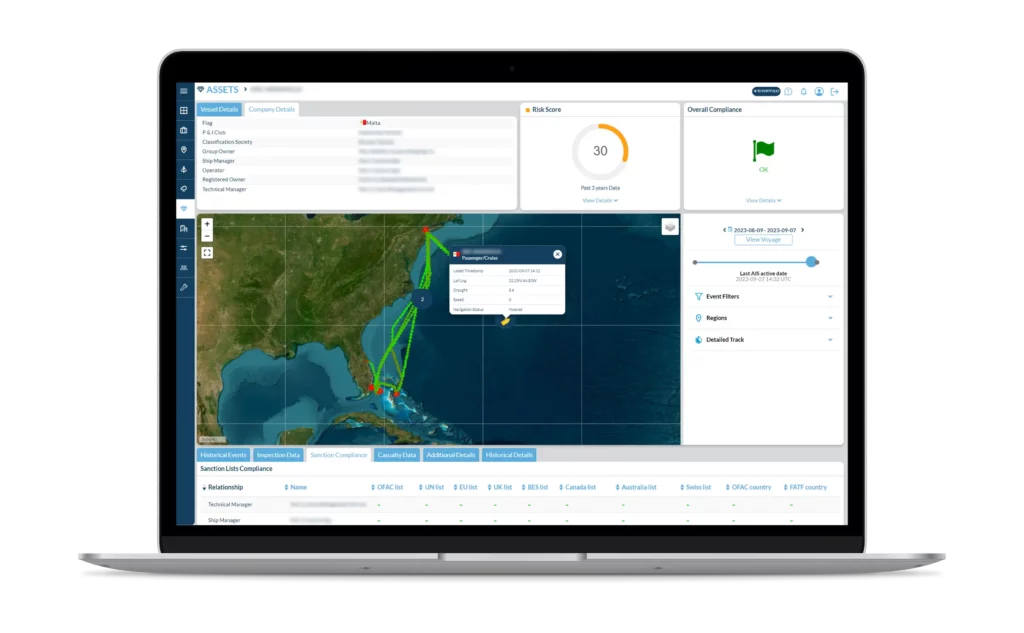

- Track location of assets and view risk scores and ESG ratings

- Alerts can be easily configured and monitored based on risk scoring, accumulation, location etc.

Benefits

Make more informed underwriting decisions

Identify low risk vessel owners and portfolios

React quickly to events with real time information

Reduce the risk of asset accumulation

Use Cases

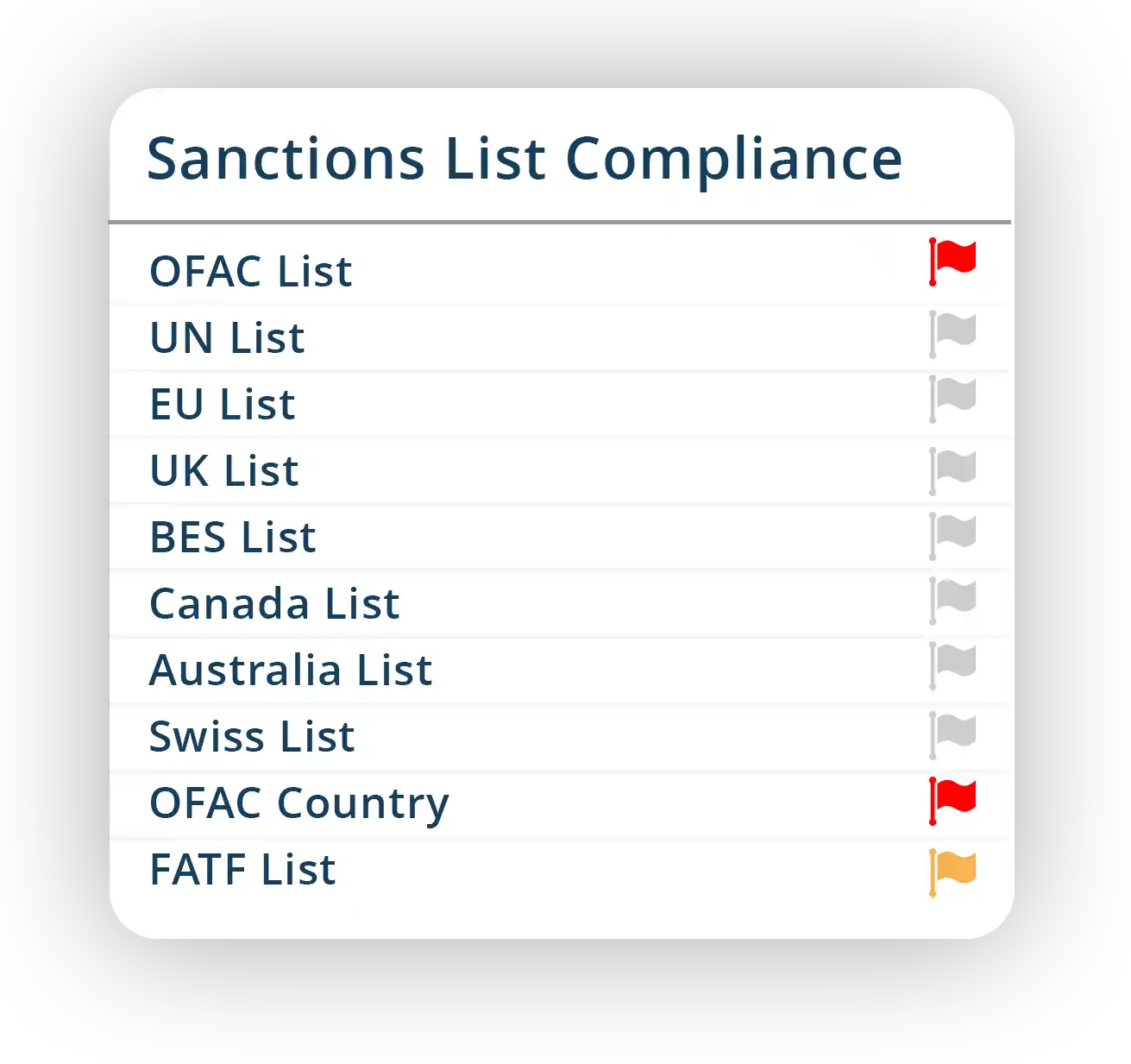

Insurance companies face significant reputational and financial risks associated with non-compliance...

Insurance companies face the growing challenge of managing Environmental, Social, and Governance (ESG)...

Timely and accurate claim investigations are crucial for insurance companies to protect their interests...

Accurately assessing maritime risk and setting appropriate premiums is crucial for insurance companies...

Insurance companies are increasingly facing the challenge of managing war risks associated with maritime...