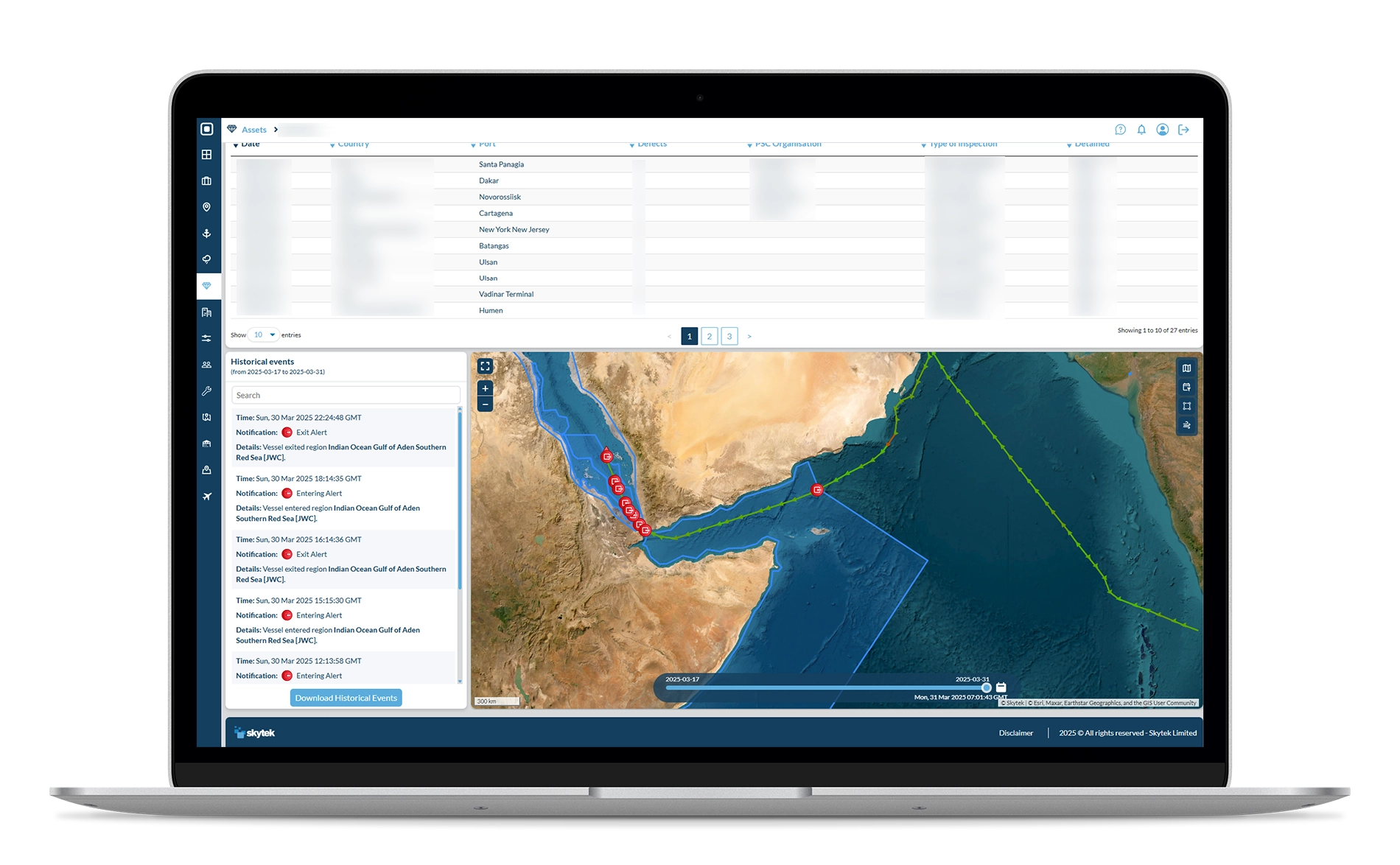

Detect and prevent risk aggregation

Proprietary Skytek technology tracks asset movements and can answer questions such as ‘show me my top 5’ global exposures. An effective risk management tool, exposure across different lines of business can be easily monitored. The historical analysis allows companies to understand better asset movements and the spread of the risk on a global scale.

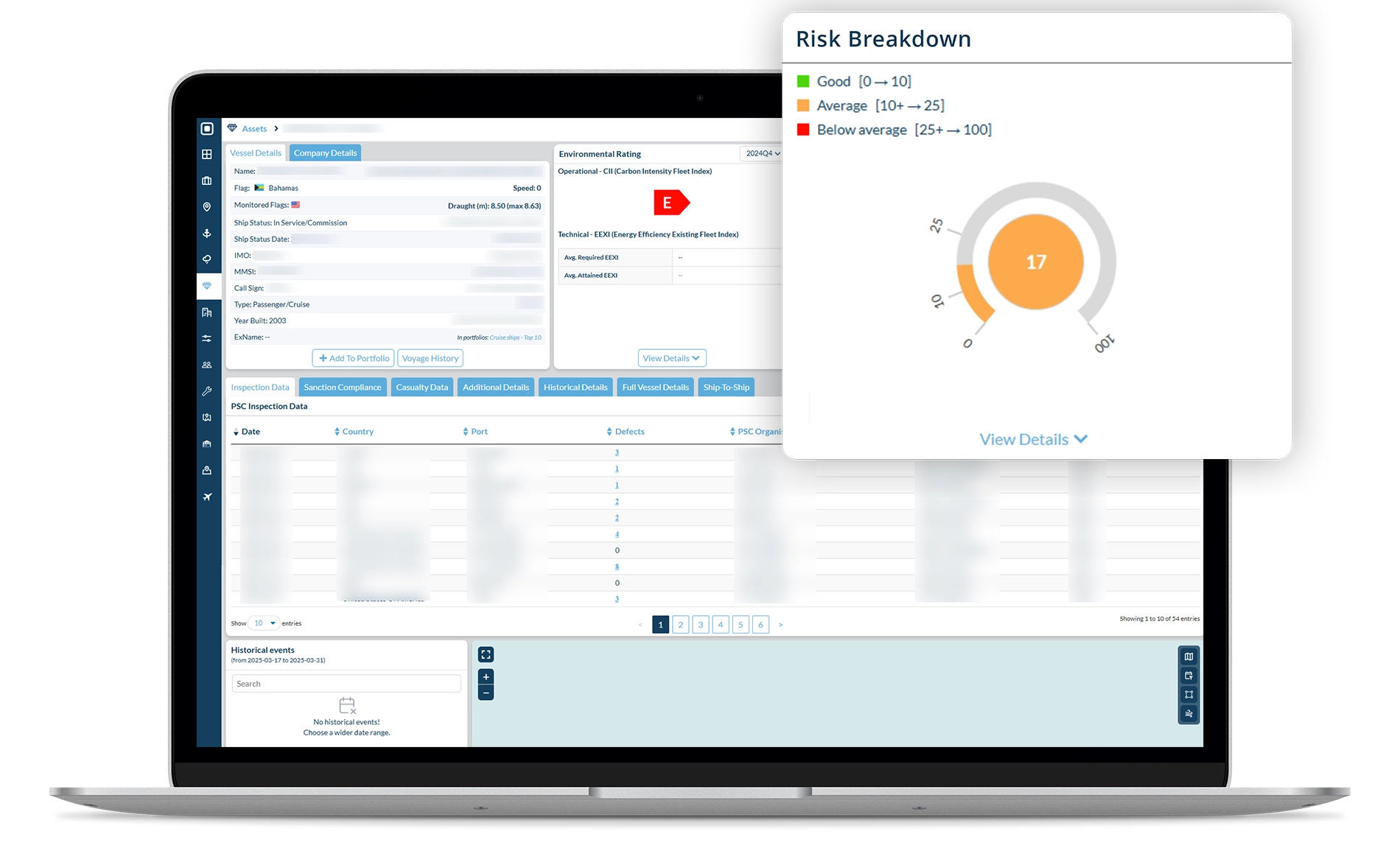

Risk scoring

Client portfolios are risk scored using a transparent scoring system to improve underwriting decision-making, easily compare organisations and target new clients. Underwriters make money based on their ability to select risk. Crucially, Skytek’s proprietary algorithm can be tailored to suit an organisation’s appetite for risk. Parameters can be easily changed.

Immediate calculation of potential loss

Real-time monitoring of risk for immediate feedback on potential or actual loss exposure. Providing real-time feedback on potential event exposure helps eliminate market volatility and uncertainty.

Claims management

The system allows companies to assess the validity of potentially “in dispute” claims, such as vessels ‘lost at sea’. Real-time monitoring will confirm location, track movements, weather conditions, and other information to understand underlying claim circumstances better. In addition, Earth Observation techniques can determine and apportion responsibility for environmental breaches.