Lines of Business:

Roles:

Recent News

June 25, 2025

No posts found

In recent times, insurance companies have encountered a growing challenge in effectively navigating and mitigating the complexities associated with managing war risks within the realm of maritime operations. This issue is particularly pronounced in regions characterized by heightened volatility, where geopolitical tensions, civil unrest, and other geopolitical factors pose significant threats to the safety and security of maritime activities.

The maritime industry, being inherently global and interconnected, has witnessed a surge in the need for comprehensive insurance solutions that address the multifaceted nature of war risks. These risks encompass a spectrum of potential issues, ranging from piracy and acts of terrorism to armed conflicts and political instability. Insurance companies find themselves at the forefront of devising innovative strategies and policies to provide adequate coverage and protection for shipowners, operators, and other stakeholders in the maritime supply chain.

The dynamic nature of geopolitical events demands a constant reassessment of risk factors, requiring insurance companies to stay abreast of evolving global situations and their potential impact on maritime operations. This involves not only monitoring traditional war zones but also considering emerging threats in previously stable regions, as geopolitical landscapes can change rapidly.

To meet these challenges head-on, insurance companies are leveraging advanced risk assessment technologies, data analytics, and strategic partnerships with security experts. By adopting a proactive approach, insurers aim to anticipate and respond swiftly to emerging risks, thereby ensuring the sustainability of their coverage and safeguarding the interests of their clients.

The conventional techniques employed for tracking vessel locations and monitoring areas designated as war zones often prove to be insufficient and prone to inaccuracies. In an era where maritime operations have become increasingly complex and dynamic, relying solely on traditional methods may pose significant challenges in maintaining a precise and up-to-date understanding of vessel movements and the evolving geopolitical landscape.

Satellite-based tracking systems, while revolutionary in their own right, may encounter limitations in certain scenarios, such as adverse weather conditions or intentional efforts to conceal a vessel’s location. This underscores the need for diversified and technologically advanced tracking solutions that can transcend these challenges and provide more reliable and real-time data.

In response to these limitations, there is a growing emphasis on integrating emerging technologies like artificial intelligence, and machine learning into maritime tracking systems. These technologies offer the potential to enhance the accuracy and efficiency of vessel monitoring by analyzing patterns, predicting movements, and ensuring the integrity of data.

Furthermore, the inadequacies of traditional monitoring methods become even more apparent in regions where conflicts and geopolitical tensions are prevalent. The fluid nature of these situations requires a more adaptive and proactive approach to tracking and monitoring. Insurance companies and maritime stakeholders are increasingly exploring partnerships with technology firms specializing in geospatial intelligence and data analytics to bolster their capabilities in understanding and responding to evolving risks.

In conclusion, the limitations of traditional methods for tracking vessel locations and monitoring war zones highlight the necessity for a paradigm shift towards more advanced and technologically sophisticated solutions. Embracing the potential of cutting-edge technologies not only addresses the shortcomings of existing methods but also opens new avenues for improving the overall effectiveness and precision of maritime monitoring in an ever-changing global landscape.

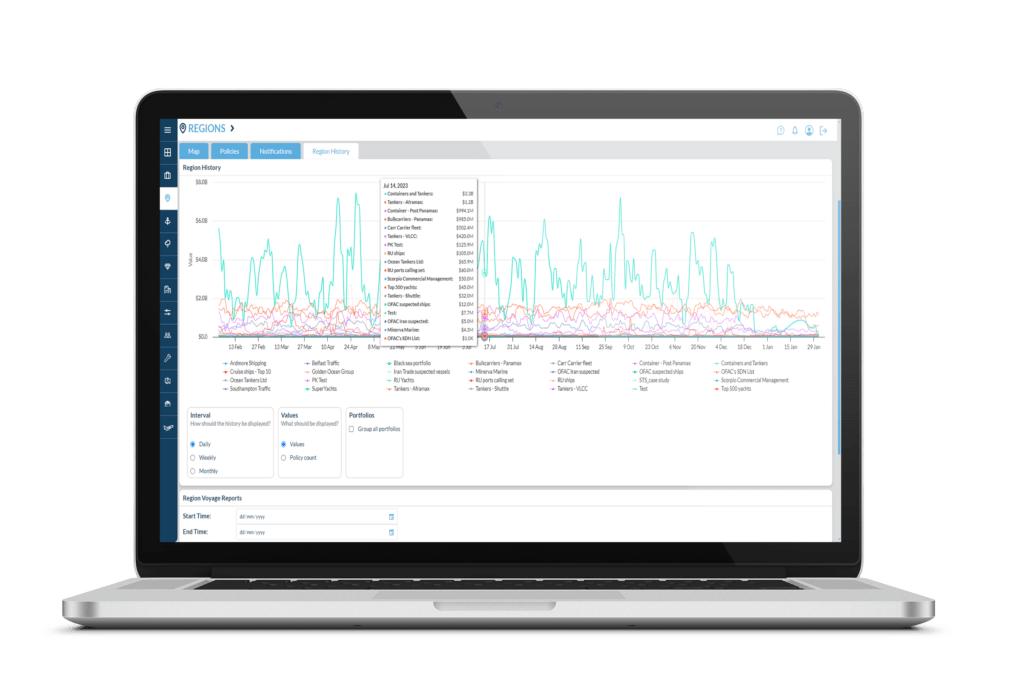

Skytek’s maritime intelligence platform utilizes advanced data analytics and satellite imagery for real-time visibility into vessel movements and war risks. This proactive approach empowers insurers to identify and mitigate risks, safeguarding shipping fleets from potential losses.

In maritime risk management, timely information is crucial. Skytek’s platform offers insurers a comprehensive overview of the maritime landscape, addressing challenges such as geopolitical tensions and war risks. The platform transforms risk assessment into a dynamic process, using satellite imagery for precise monitoring of vessel movements.

In conclusion, Skytek’s maritime intelligence platform, with advanced analytics and satellite imagery, reshapes how insurers approach risks in the maritime industry. This proactive stance exemplifies the synergy between technology and risk management, providing real-time visibility and protection for shipping fleets.