Risk is inevitable, and indeed insurers’ source of profit, but managing it is increasingly complex

Insurers are more used to risk than other industries, but exogenous factors, from politics to climate, are making the world riskier than ever. In light of this fact, insurers can use data to better understand risk and, in doing so, reduce it.

Surveying today’s world one thing is for sure: the political environment is more unstable than it had been for decades. There is little sign of this improving: as the post-Cold War era fades into memory, geopolitics today is driven by regional animosities and power plays, notably in the Americas, in the Middle East and south and east Asia.

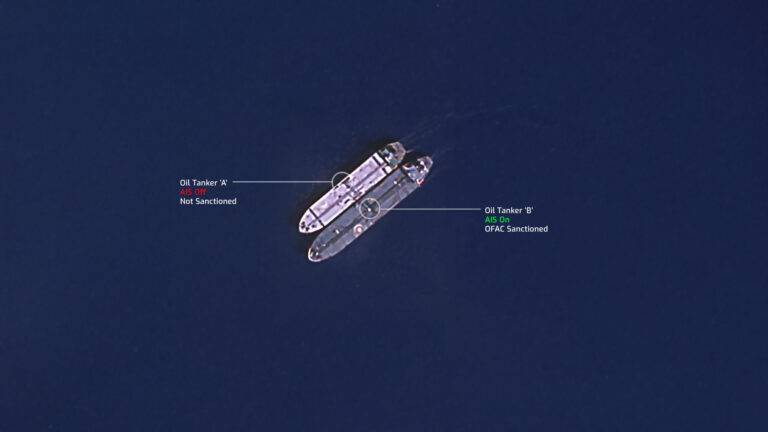

The US focus on Iran, North Korea, and Syria is instructive: by publishing an advisory on how these countries evade sanctions, such as with ship-to-ship transfers, the US was firing a warning shot across the bow of the re/insurance sectors, alongside owners, flag registries, port operators, commodity traders and financial institutions.

Today insurers and reinsurers are at risk of underwriting illegal activity at sea. Sanctions breaches are on the rise, particularly in oil transport, but also refined petroleum, petrochemicals, steel, iron, aluminium, copper, sand, and coal, and vessels are often “going dark” by turning off transponders in order to disguise the fact that they are engaging in covert ship-to-ship transfers.

n May 2020, the US government published an advisory specifying the risk to insurance companies, singling out such practices, along with “spoofing” the signal by pretending to be another vessel and noting voyage irregularities, ship-to-ship transfers, byzantine changes in ownership and other methods of evading sanctions.

The US government is now saying the industry needs to work smarter—and work together: AIS should be monitored more closely and ships should be followed throughout their entire ownership lifespan, while P&I Clubs should notify others of suspicious activity.

At the moment this kind of data sharing is rare, with vessel date seen as commercially sensitive. Moreover, information is also scarce, scattered, often out of date, and, as noted above, in some cases actively being tampered with.

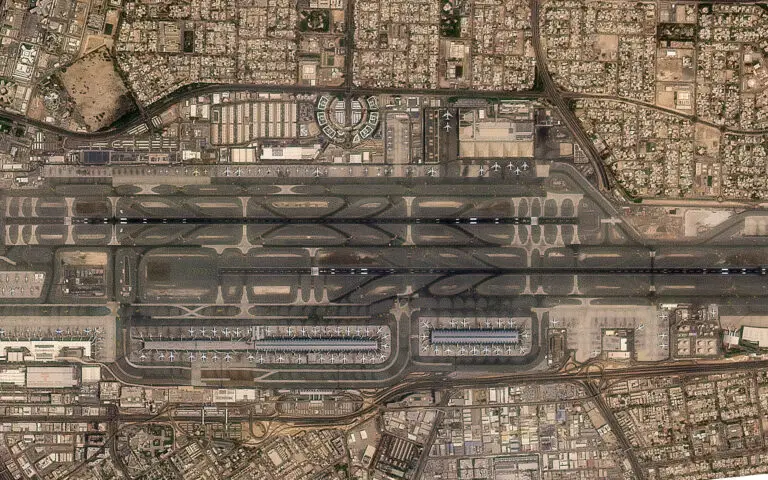

In late July 2020, the UK government tightened its compliance regime. Companies are now expected to carry out “checks on ownership structures, vessel flag information, details of home ports and recently visited ports” when conducting maritime trade transactions.

In addition, insurers doing businesses in both the EU and the US may be caught in the middle of two conflicting sanctions regimes.

Likewise, an increased focus on climate change is about more than planning for extreme weather: it also means mitigation and, hence, taking account of energy use by the shipping industry. More efficient routes and vessels can be rewarded, while those with insufficient concern for environmental issues penalised.

The only way to continue doing business in such an environment is to keep a close eye on what vessels are doing, removing cover from any that engage in illegal activity that brings undue risk to insurers.

Armed with the correct information and intelligent tools to underpin decision-making, insurers can react rapidly to circumstances by changing policy, so reducing business disruption and cost, and, ultimately, leading governance rather than merely responding to it.

With the right technology at their fingertips, insurance companies can transform their businesses: the application of data, both live and historical, will not only drive down losses but allow for the development of new products and guide sustainable growth.

To keep one step ahead and make compliance work for you, read more in our CUO’s Guide to Industry 5.0, Ebook series. Click the banner below for part 2 Leading Compliance.