One Insurance Platform to Manage your Global Portfolios in Real-Time

Disruption should be the last thing any business wants, but in today’s fast-changing world adopting the right technology can future-proof a company’s success by taking evolutionary steps to avoid the disruption of a revolution.

REACT from Skytek has the suite of tools that allows the insurance and reinsurance sector to do just this, looking to the future of technology with an advanced analytics capability that draws on deep datasets and paired with easy to use dashboards that allow underwriters to prepare for the future by looking simultaneously at the present and past.

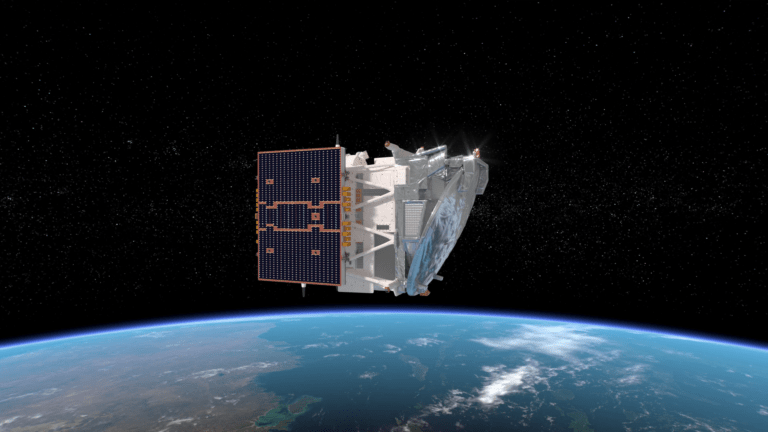

Combining geolocation data, satellite imagery, machine learning and a wide range of historical data, underwriters and brokers can work smarter and faster by shining a spotlight on any region of the world. Risk scores can be calculated according to chosen underwriting parameters, allowing for automated portfolios and a risk dashboard that provides foresight of accumulations and a benchmark of risk appetite.

“REACT is uniquely powerful, putting decision ready data at the fingertips of insurers, reinsurers and brokers when they need it, but it is also familiar and easy to use, and as a cloud-based suite with fantastic integration API’s it doesn’t need to be updated or reinstalled, and can seamlessly integrate into existing technology and modelling software” said Skytek chief executive Dr Sarah Bourke.

Offering a 360-view of your business, from live asset location tracking alongside Earth Observation satellite imagery, a variety of essential background information on static and moving assets, for marine, aerospace, energy, offshore, property and infrastructure. REACT is a state of the art technology platform providing real-time and predictive insights to supplement data modelling with ground truth facts. REACT enhances the underwriting process, enabling insurers and reinsurers to manage live CAT events and future proof organisations with ESG (Environmental Social & Governance) scoring and compliance.

REACT can be used across all insurance classes and with its revolutionary ability to tailor risk selection and to support underwriting decision-making, REACT is ushering the fastest possible change, but doing it with ultra-rapid evolution rather than costly and disruptive revolution.

With hurricane season underway, and the growing threat of climate change making extreme weather more a frequent occurrence, insurers can stay ahead of risk by using REACT to not only track asset location but examine behaviour, such as clustering in high danger zones, and remove or adjust cover in light of risky behaviour.

Skytek REACT’s combination of earth observation imagery and AIS data, as well as access to key underlying information such as utilisation, maintenance, registry, ownership and historical data, offers a powerful set of tools for protecting insurers from foreseeable losses.

Weather is far from the only threat to insurers, though: 2020 showed us that freak events do occur and often in rapid succession, from the Port of Beirut explosion to the MV Ever Given blocking the Suez canal,

Naturally, no software suite can stop this, but REACT is unique in its ability to observe locations and facilitate pre- and post-event with machine learning to expertly analyse earth observation image comparisons, thus allowing insurers to see the true extent of damage and understand the timeline of events in the run up. This pre- and post-event functionality can drive accurate and rapid loss assessment and identify breaches of coverage.

In addition, with Environmental, Social and Governance (ESG) issues rising to the top of both the corporate and public agendas, REACT now allows users to maintain and adapt with compliance needs at a high level to understand the impact of events, from potential or immediate environmental damage to on the ground insights including excess fuel use and emissions following potential rerouting.

“REACT is a true game changer. The perfect solution where technology supports and enhances the role of the insurer to add value, identify opportunities and ultimately improve profitability and growth,” said Christian Silies, Head of Marine, Energy, Composite at Aon Reinsurance Solutions at Aon.

With REACT, businesses, teams and clients can be more insightful, more productive and improve risk management. REACT allows Insurers and brokers to accurately manage underwriting and claims as well as expand their business by developing new products and differentiate themselves from competitors with value added services and insights.

“With historic and predictive data REACT is the modern scalable solution, providing insurers with the hindsight, full sight, and foresight to deliver smarter, faster decisions.

In this new digital era technology will have a major influence on the future success of insurance however this is not about drastic disruption and change this is about a natural evolution of continual improvement where technology supports and enhances decision making not replaces the value and insight of industry professionals. The new era of the ‘digital insurer’ is already upon us; it’s now down to industry leaders and early adopters to create real differentiation and in turn, improve profit and growth” said Skytek’s Dr Sarah Bourke.

To find out more and request a personalised demonstration of REACT get in touch info@staging.skytek.com