Insurance companies must remain acutely aware of the substantial reputational and financial risks that loom large when it comes to non-compliance with stringent sanctions regulations. In an era marked by heightened global scrutiny and increasing regulatory oversight, the consequences of failing to adhere to these sanctions extend far beyond mere financial penalties. The repercussions can severely impact the reputation of the insurance entity, leading to a loss of trust among clients, partners, and stakeholders.

Non-compliance with sanctions not only exposes insurance companies to legal ramifications and fines but also raises the specter of severe damage to their standing in the industry. The interconnected nature of the global financial system means that any missteps in adhering to sanctions can trigger a cascade of negative effects, affecting relationships with international partners and potentially leading to exclusion from vital markets.

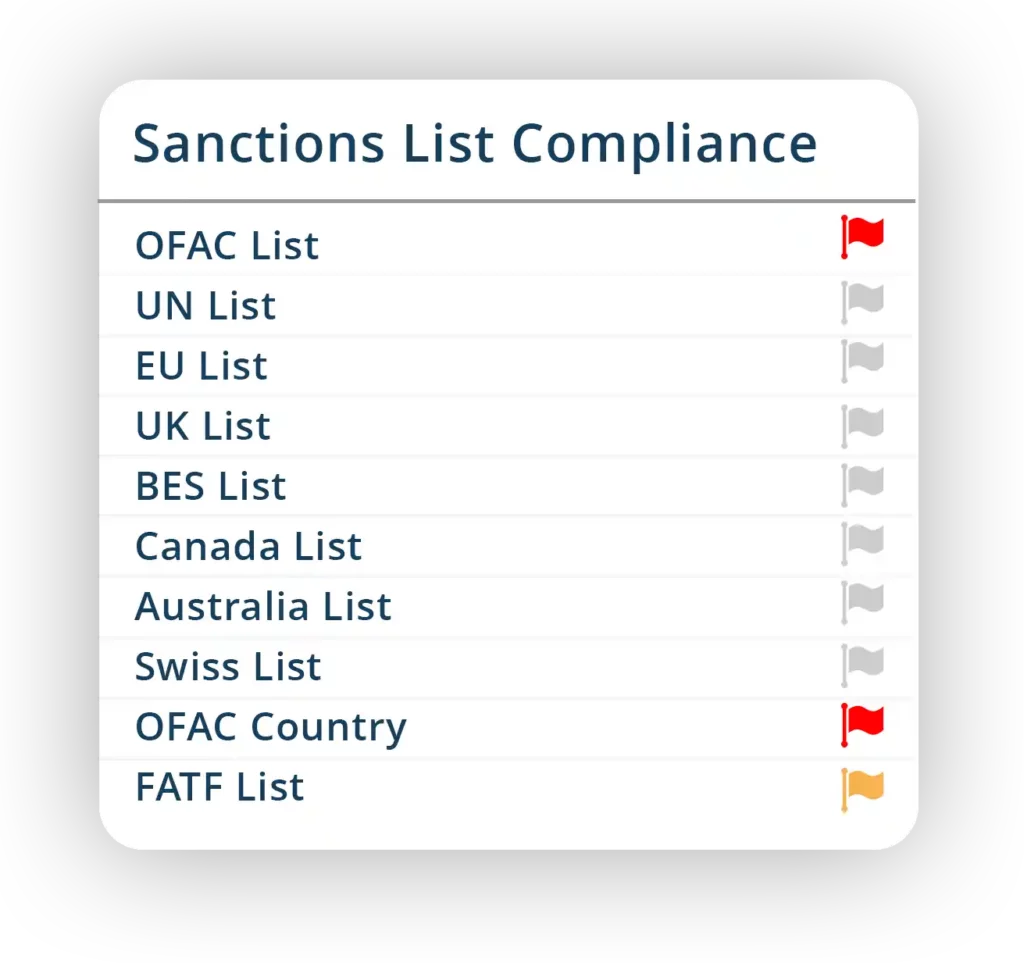

Moreover, the financial risks associated with non-compliance extend beyond immediate penalties, encompassing potential disruptions to business operations, increased compliance costs, and the erosion of shareholder value. Insurance companies, therefore, find themselves compelled to invest significantly in robust compliance frameworks, sophisticated monitoring systems, and ongoing staff training to ensure a proactive and vigilant approach to sanctions adherence.

In essence, the intricate web of sanctions regulations requires insurance companies to not only navigate the complexities of the legal landscape but also to actively engage in risk mitigation strategies. Fostering a culture of compliance, embracing technological advancements in monitoring and reporting, and staying abreast of evolving sanctions frameworks are imperative steps for insurers seeking to safeguard their reputation and financial stability in an environment where non-compliance is not just a regulatory concern but a strategic imperative.

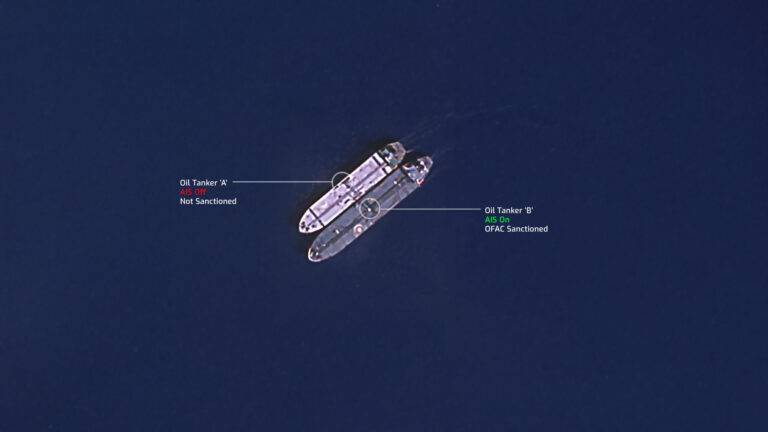

The manual monitoring of vessel movement and the verification of adherence to sanctions lists represent a precarious process fraught with inefficiencies and susceptibility to human error. In this era of technological advancement and heightened regulatory scrutiny, relying solely on non-automated methods not only jeopardizes the efficiency of the monitoring system but also significantly elevates the risk of non-compliance for businesses operating in the maritime sector.

Human-intensive processes in vessel movement oversight create an environment where the likelihood of errors, oversights, and delays is inherently heightened. The complexity of navigating through intricate sanctions lists and the sheer volume of data to be processed make manual monitoring a time-consuming and resource-intensive endeavor. Moreover, the dynamic nature of global trade and the constantly evolving landscape of sanctions further compound the challenges faced by those dependent on non-automated methods.

The consequences of such inefficiencies are manifold. Beyond the increased risk of inadvertent non-compliance, companies may find themselves grappling with delays in decision-making, potentially leading to missed opportunities or heightened exposure to risks. The financial implications are not to be underestimated, as manual processes often demand a significant allocation of human resources, driving up operational costs and diverting valuable personnel away from more strategic tasks.

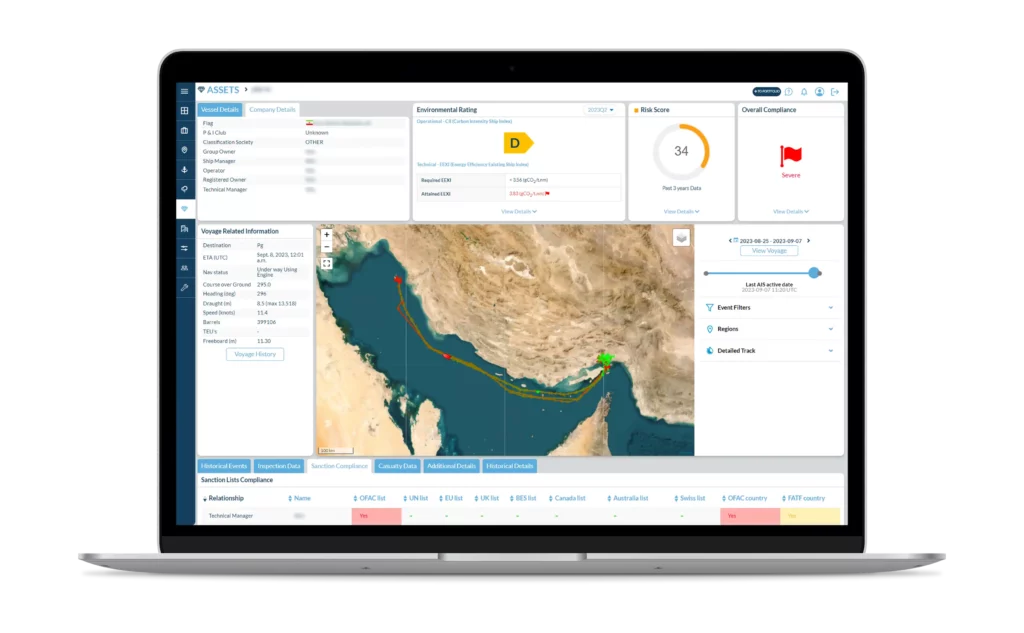

To navigate this landscape effectively, businesses in the maritime sector are compelled to embrace automated monitoring solutions. Leveraging cutting-edge technologies such as artificial intelligence, machine learning, and real-time data analytics not only enhances the accuracy and speed of monitoring but also mitigates the risk of human errors. By incorporating automated systems into their compliance protocols, companies can proactively address the challenges posed by non-compliance, ensuring a more streamlined, efficient, and error-resistant approach to vessel movement monitoring and adherence to sanctions lists.

By integrating with vessel tracking systems and sanctions lists in force, Skytek can automatically identify vessels that are potentially listed for sanctions violation. This proactive approach enables insurers to investigate immediately, take corrective action if necessary, and avoid potential reputational damage and financial penalties.