The integration of ESG considerations into maritime insurance signifies a paradigm shift, necessitating a comprehensive approach to address the multifaceted impacts and implications on the industry.

The environmental dimension of ESG involves grappling with the repercussions of climate change, rising sea levels, and ecological concerns, all of which can significantly impact the maritime sector. Insurance companies must navigate the complexities of assessing and mitigating these environmental risks to ensure the sustainability and resilience of their portfolios. Additionally, the social aspect entails considerations of human rights, labor practices, and community well-being within the maritime industry. As insurers assess their exposure to social risks, they are compelled to align their policies with ethical standards and promote responsible practices among insured entities.

Furthermore, the governance facet of ESG brings forth the imperative of transparent and accountable governance structures within maritime operations. Insurers must scrutinize the governance frameworks of their insured entities, emphasizing adherence to ethical business practices, regulatory compliance, and risk management protocols.

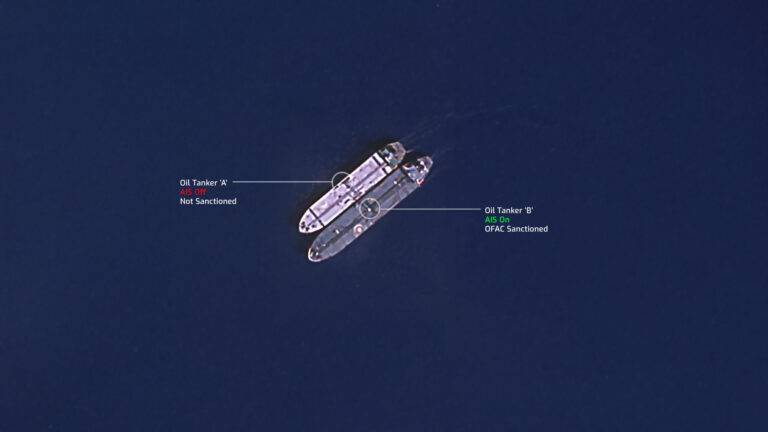

To effectively manage these ESG risks, insurance companies are increasingly adopting proactive measures. This involves integrating ESG criteria into underwriting practices, conducting thorough due diligence on insured entities’ sustainability practices, and fostering partnerships with clients committed to ESG principles. Additionally, the deployment of advanced technologies, such as data analytics and satellite imagery, aids insurers in monitoring and assessing environmental impacts and adherence to regulatory frameworks.

The challenge of obtaining reliable and comprehensive data on ships’ Environmental, Social, and Governance (ESG) performance stems from the global nature of the shipping industry, with vessels operating under various flags and jurisdictions. This complexity hampers data collection and standardization. Each regulatory environment has distinct reporting standards, hindering the aggregation and comparison of ESG information. To address this, collaborative initiatives and standardized frameworks for ESG reporting are crucial. Technological advancements can enhance transparency and facilitate seamless data sharing. Overcoming these challenges requires a collective effort to foster collaboration and embrace innovation, paving the way for a more transparent, accountable, and sustainable maritime sector.