In the realm of insurance, prompt and accurate claim investigations are crucial. They serve as a linchpin for insurers to protect their interests, ensure fair settlements, and maintain industry integrity. Timely assessments expedite claims resolution, enhance customer satisfaction, and prevent complications. The accuracy of investigations is vital for fair settlements, minimizing the risk of oversight and fraud. To strike a balance, insurers are adopting advanced technologies, such as AI and data analytics, streamlining processes and enhancing risk assessments. In essence, the synergy of timely and accurate claim investigations is foundational for insurers navigating the complexities of the industry, contributing to trust, transparency, and fairness.

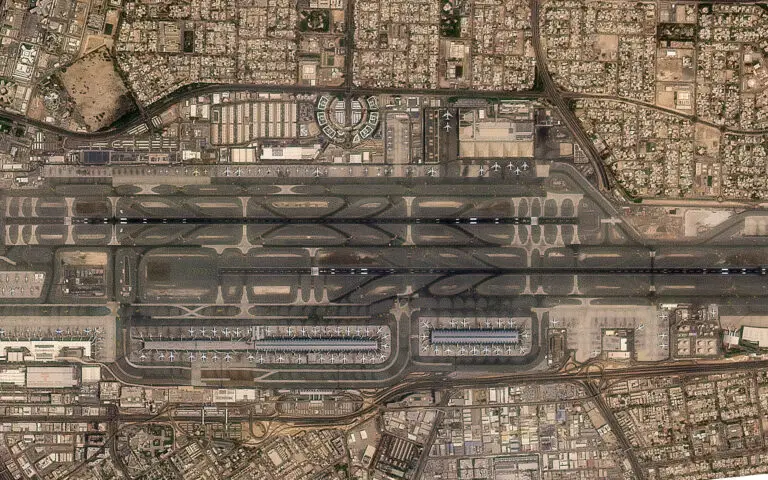

The challenge of investigating casualties in remote locations arises from limited access, hindering the collection of crucial evidence for supporting or refuting insurance claims. Geographical remoteness can lead to delays and logistical complexities, impacting the efficiency of investigations. This may result in incomplete data and a delayed understanding of the incident’s circumstances. To address this, Satellite and Earth Observation technologies become essential. These tools enhance the ability to gather vital information remotely, mitigating the challenges posed by geographical constraints and ensuring a more timely and comprehensive investigation process.

Leveraging the capabilities of advanced satellite imagery analysis, Skytek demonstrates a cutting-edge approach to evaluating marine casualties. Through a meticulous examination of satellite data, Skytek not only assesses the severity of damage but also adeptly identifies potential inconsistencies that may serve as red flags signaling fraudulent claims. This sophisticated analysis is a game-changer for insurers, providing them with a robust tool to make well-informed decisions regarding claim settlements.

The utilization of satellite imagery introduces a new dimension to the assessment process, offering insurers a comprehensive and visual understanding of the extent of damage incurred during a marine casualty. The ability to scrutinize high-resolution images aids in precisely gauging the severity of the incident, enabling insurers to ascertain the validity of the claims submitted. This visual evidence becomes invaluable in situations where traditional methods might fall short, offering a more holistic perspective on the circumstances surrounding the maritime event.

Moreover, Skytek’s advanced analysis goes beyond mere damage assessment. By meticulously scrutinizing the satellite data, the system identifies patterns, anomalies, and inconsistencies that may raise suspicions of fraudulent activities. This proactive approach to fraud detection empowers insurers to preemptively address potential risks, ensuring a more secure and reliable claims management process.

In the grand scheme of claim settlements, this technological innovation significantly mitigates the risk of falling victim to fraudulent claims. Insurers armed with the insights derived from satellite imagery analysis can navigate the claims landscape with heightened confidence, fostering a more secure and efficient environment. The integration of such advanced technologies not only bolsters the accuracy of decision-making but also contributes to the industry’s ongoing efforts to combat fraud, ultimately resulting in a more resilient and trustworthy insurance ecosystem.